If you’ve been to veterinary school, you know the burden of student loan debt that purchased your education. Going into your first post-graduate year, you definitely expected tuition costs, and of course living expenses. You may have even anticipated the fees that are included for purchasing equipment and instruments.

But, what about all the hidden costs included in a veterinary education? As you go through the four-year track, extra expenses like accrued interest, tuition inflation, and mandatory student fees begin adding up. In this article, you’ll learn more about these secret costs for veterinary students. Many student choose to pay for these costs by borrowing more in student loans, driving their debt-to-income ratio higher.

If you are looking for guidance with your student loans, contact Loyall Group today. We connect veterinarians with a nationally recognized student loan expert. He will work with you, your dreams, your career aspirations, and your unique student loan mix to find a pathway forward.

Starting with the Application

Before veterinary students can apply to schools, they must take the GRE. This generally costs around $200 to take, and an applicant can have scores submitted to four schools within that initial cost. Then, during the admission process, veterinary students face high admission fees. Most veterinary schools cost $200 or more to submit the application. Deciding which schools to apply to is essential in keeping upfront costs down.

Not only is there an admission fee, but veterinary schools require an interview. If you are a student who is applying to schools around the country, you will be responsible for travel costs, lodging, meals, and wardrobe costs associated with successful interviews. Merely applying to veterinary schools has thousands of dollars of unassumed costs involved.

Tuition for Veterinary Schools often Doesn’t Include the Expensive, and Mandatory, Fees

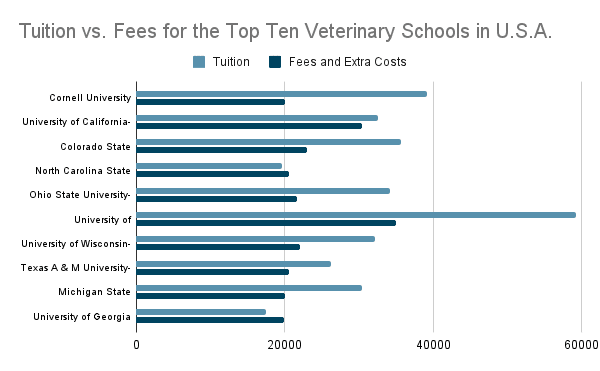

As the chart below shows, tuition at the top veterinary schools often includes fees. These fees sometimes don’t have explanations as to what they are used for within the education. However, most veterinary schools have fees due to the costs of instruments, tools, and medical facilities.

Another aspect of the fees that drive student loan debt for veterinarians are the living expenses fees. Books for school, telephone, rent, and health insurance are some of these costs that are paid for with student loans.

Take a look at the following chart to see what the fee costs are for the top ten veterinary schools in the United States. The numbers are assuming a student is full-time, in-state resident.

Data compiled from university websites, current as of 2021.

As you can see, fees cover a substantial portion of the costs of earning a veterinary degree. For over half of the top ten universities, fees and living expenses are at least twice as much as the tuition itself. But, these up-front, indirect costs aren’t the only secret fees involved in a veterinary degree.

Tuition Inflation During Veterinary Programs

Even after you begin veterinary school, your tuition rate isn’t guaranteed for the duration of four years. Instead, it very often takes a hike each year veterinary students are in the program. In this year’s Annual Data Report from the AAVMC, tuition for residents increased by 3.7%. This isn’t unusual. Another graphic from the AAVMC shows that veterinary tuition has increased steadily over the last 30 years.

There are many reasons for this. The largest reason is the reduced availability of government and public support. Increasing technological requirements, accreditation regulations, and services to students are among the other top reasons for increasing tuition. And, while the money usually goes to great use, such as research, labs, diagnostics, and instruction, the burden of the cost is still placed on the shoulders of students.

Accrued Interest on Student Loans

Additionally, while your student loans may be put into deferment during post-graduate work, some types of loans will still accrue interest. In fact, if you take out unsubsidized loans or additional loans for graduate school, these will immediately begin accruing interest.

That means that you’ll be multiplying your debt trying to get through additional schooling. And, if you choose to specialize, your loans will continue accruing interest if they are unsubsidized. Some income repayment plans [link to income repayment plans loyall blog post] may be able to help pay the interest if you qualify.

Consider the High Debt-to-Income Ratio that Veterinarians Graduate With

When you are going through veterinary school, always take the time to work out how you will pay for the education. Only take the loans you know you’ll need. According to the AVMA, the average veterinarian graduates with a debt-to-income (DTI) ratio of 2:1. And 20% of graduates have a DTI of 4:1.

A good DTI around 35%, much less than the 50% that veterinarians graduate with. Since most veterinary schools take 4 years to complete, on top of 4 years of undergraduate work, many veterinarians are coming out of school at a time in life when they want to accomplish other life goals. Goals like getting married, buying a house, or beginning to invest in retirement seem far-fetched when you are dealing with the daily grind of paying a student loan bill. Especially a student loan bill that is as expensive as your parent’s mortgage.

Then there are those veterinarians who want to own their own practice. If you are going to be purchasing a practice, you will want to keep your debt-to-income ratio balanced. Learning about pathways to handle your debt is the first step to getting on a steady financial footing.

One of the best ways to learn about how to conquer your student loan debt is to consult an expert. A professional student loan counselor can help find a personalized and individualized solution for you. Navigating the student loan rules can often feel overwhelming. Connect with Loyall Group today; we will partner with you through nationally recognized affiliates to bring calm to the chaos.